Business

Newsday

Thursday 18 February 2021

GEOLOGICAL SOCIETY OF TRINIDAD AND TOBAGO

Trinidad and Tobago is a mature hydrocarbon producer with over 100 years in the business. Our geology is extremely complex, unlike the passive margin deposits being found offshore Guyana and Suriname.

Exploration in TT has always been very risky. Our producing fields are in various stages of maturity and many require large capital investments to improve or just maintain production.

The oil story remains grim, with oil-plus-condensate production averaging 56,000 barrels per day in 2020. Most of the known oil resources lie with Heritage, which is yet to demonstrate any tangible plans for meaningfully increasing oil production.

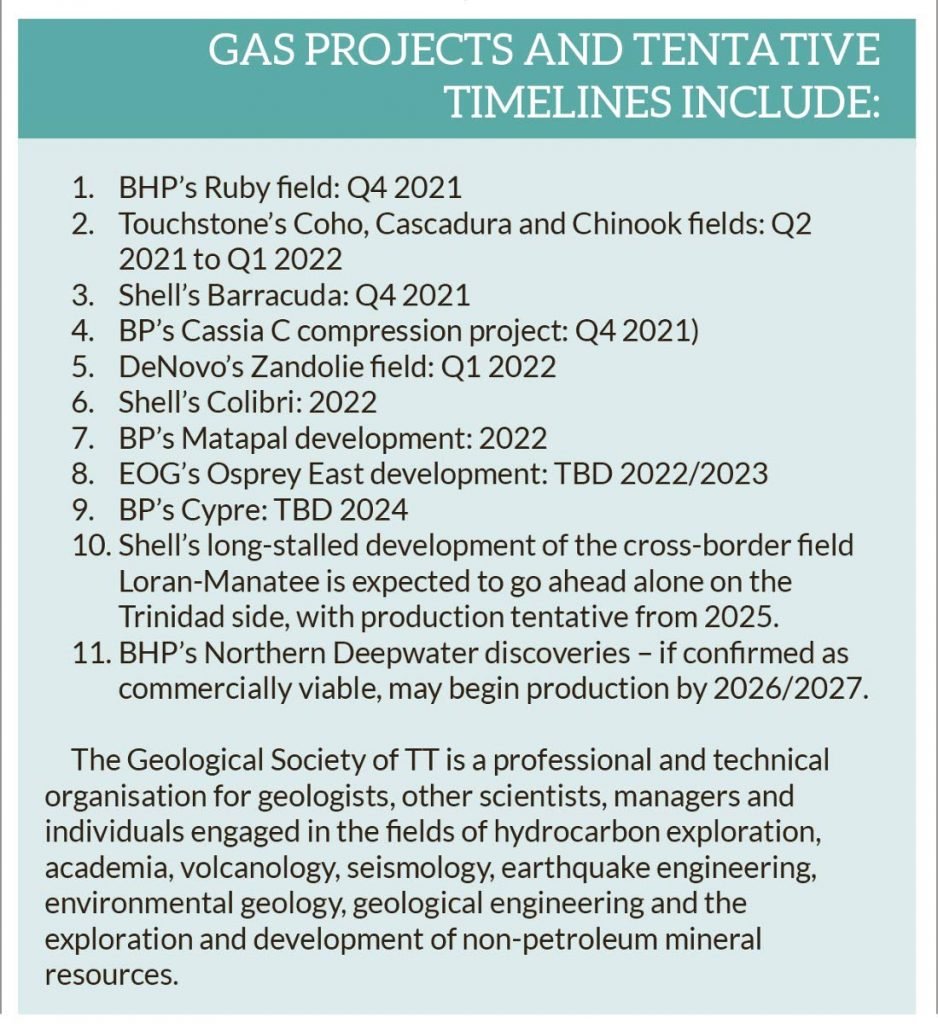

However, the country remains a major gas producer, averaging about 3.1 billion cubic feet per day (bcf/d) in 2020, albeit far less than 4.3 bcf/d at our peak around 2010. The good news is that several gas development projects are under way which will boost upstream operators’ profits and therefore government taxes, as well as bringing much-needed relief to the downstream plants at Pt Lisas. (See box)

At the end of 2021, new gas production of 400-450 million standard cubic feet per day (mmscf/d) could be added; 2022 could add as much as 700 mmscf/d. Loran may produce 350 mmscf/d, and preliminary deepwater projections are anything between 600 and 1,000 mmscf/d.

Production of gas from a reservoir can be likened to the gas released when you open a soft drink. The pressure is high at the beginning, but over time the pressure decreases, and it goes flat. The reservoirs work similarly. Gas production starts high and may continue for a few years, but then decreases rapidly.

The decline curve explains why bid rounds are so essential to maintain production. As some fields slow down, new ones must come online to fill the gaps. Fields can only be developed after discoveries are made. Discoveries are most often made after exploration drilling, driven by new acreage awarded during bid rounds.

In the last few years, the only real bright spots for exploration in TT have been BHP’s deepwater discoveries and Touchstone’s onshore gas/condensate finds. Both sets of discoveries are the result of contracts signed between the operators and Ministry of Energy between 2011 and 2014.

Since 2014, no new acreage has been awarded. It is therefore highly likely that after 2025, if Loran and the Deep water don’t pan out, our gas industry will again face a shortage of projects.

The Energy Ministry had one failed bid round recently and is planning a new deepwater and possibly an onshore round. Unlike in years gone by, TT now has major competition for investment from our neighbours in Suriname and Guyana, where close to ten billion barrels of recoverable oil have already been found.

TT needs to focus on the smaller independents (like Touchstone) and medium-sized operators (similar to BHP, EOG) to market existing acreage to. No Exxon or Chevron will be interested in TT. We need to actively seek out companies whose risk appetites, financial and technical capacities are compatible with our geological plays and existing fields.

Tax regimes need to be tailored to the realities of our various fields. For example, mature onshore fields should have tax systems designed specifically for enhanced oil recovery and heavy oil production. Similarly, there are many small pools on the east coast that are not economic for a BP or Shell, but may be more than suitable for smaller players like a DeNovo. While some attempts at varying fiscal regimes have been done, it is not close to being sufficiently fleshed out.

Other than taxation, data availability remains a major grouse of operators. Tons of geological, geophysical and engineering information have been lost over the years and what remains tends to be kept “confidential” by the state entities until they sign acreage. Many mature producing countries have created online repositories of subsurface data and made this available freely to investors and academia. In fact, Touchstone’s recent discoveries were built on well data from as far back as the 1950s that it acquired from Petrotrin and the ministry and used modern technology and techniques to reinterpret.

Another factor to consider is the rapid transition by BP and Shell to carbon zero. Both these companies have little if any new exploration plans in TT and no development projects on the cards save for what is listed above. They have both been slashing exploration and drilling teams in Trinidad. We need to start preparing for the eventual departure of these entities from our landscape.

If major initiatives are not taken on multiple fronts, our energy sector will continue to decline rapidly, and with it, the economy and quality of life of all our citizens.

The GSTT’s membership comprises hundreds of geoscientists, petroleum engineers and economists with global experience. We are willing to work with the government to freely offer detailed analysis and create workable plans to tackle the key issues facing the industry.

The Geological Society of TT is a professional and technical organisation for geologists, other scientists, managers and individuals engaged in the fields of hydrocarbon exploration, academia, volcanology, seismology, earthquake engineering, environmental geology, geological engineering and the exploration and development of non-petroleum mineral resources.

(function(d, s, id) {

var js, fjs = d.getElementsByTagName(s)[0];

if (d.getElementById(id)) return;

js = d.createElement(s); js.id = id;

js.src=”https://connect.facebook.net/en_US/sdk.js#xfbml=1&version=v3.2&appId=136282246989460&autoLogAppEvents=1″;

fjs.parentNode.insertBefore(js, fjs);

}(document, ‘script’, ‘facebook-jssdk’));

Source link